Background and Objectives of the REIT

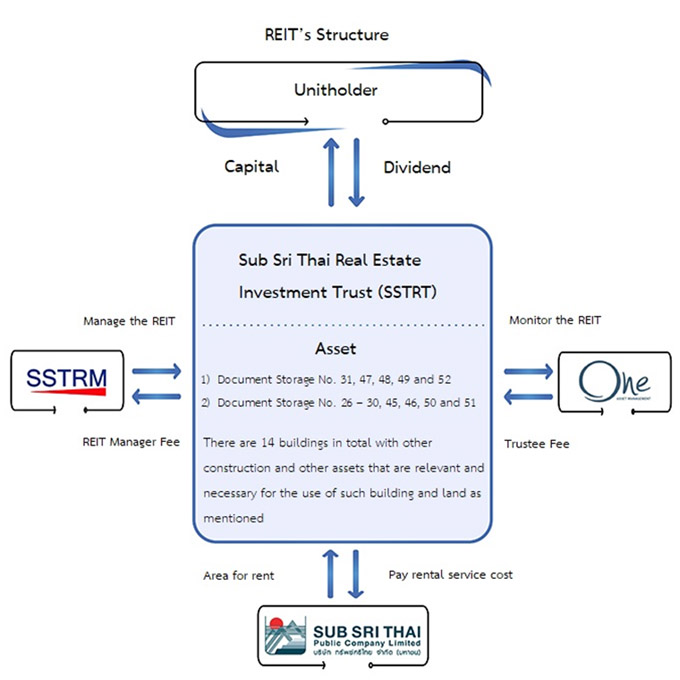

Sub Sri Thai Real Estate Investment Trust (“SSTRT” or “REIT”) has been established pursuant to the Trust for Transactions in Capital Market Act, B.E. 2550 on 13 December 2017 due to conversion from Sub Sri Thai Smart Storage Property Fund (“SSTSS”) and has been registered as securities listed on the Stock Exchange of Thailand (“SET”) on 26 December 2017 onwards. In this regard, One Asset Management Co., Ltd. (“ONEAM”) is appointed to act as the Trustee of the REIT and SST REIT Management Co., Ltd. (“SSTRM”) act as the REIT Manager.

There are 82,000,000 trust units issued to the property fund. The trust is considered as the first investment in the key assets and the trust obtained the approval from the Extraordinary General Meeting of trust holders No. 1/2019 on 17 September 2019 for the first capital increase by converting the Sub Sri Thai Property Fund (SSTPF) into the trust with a swap ratio of 1 unit per 1.1 trust units, with the newly issued trust units to the Sub Sri Thai Property Fund totaling 74,250,000 units and accepting the transfer of assets and obligations with the Sub Sri Thai Property Fund.

Objectives of the REIT

The trust is established with the objective to invest in the key assets by purchasing and/or leasing and/or sub-leasing and/or accepting the assignment of leasehold and/or sub-leasehold of key assets by using key assets to seek benefits in the form of income, rent and service charge or any other income in the same manner, as well as improving, changing, developing the potential, developing and/or selling assets with the intention to earn income and return to the trust for the benefits to the trust holders continuously in long term, as well as investing in other assets and/or other properties and/or seeking other profits by any other means according to the Security Law and/or as specified by any other relevant laws.

SSTRT Investment Policy

The REIT has a policy to invest in core assets in the category of real estate. or the right to lease real estate and assets which are parts or equipment of such real estate The types of assets that the REIT will invest in are real estate assets in the form of document warehouse buildings. and/or warehouse Including any other real estate related to supporting or promoting document storage business and/or warehouse and any other assets that may promote investment of the REIT